"Honeybunchesofgoats" (honeybunche0fgoats)

"Honeybunchesofgoats" (honeybunche0fgoats)

04/15/2019 at 21:07 ē Filed to: None

0

0

16

16

"Honeybunchesofgoats" (honeybunche0fgoats)

"Honeybunchesofgoats" (honeybunche0fgoats)

04/15/2019 at 21:07 ē Filed to: None |  0 0

|  16 16 |

Granted, I still owed, and last year was a perfect storm of really, really †bad tax planning. †Still, I dunno, I never wonít be a Democrat, but if people below the poverty line want to vote people into office who give me tax breaks, Iím not going to say no.

Quadradeuce

> Honeybunchesofgoats

Quadradeuce

> Honeybunchesofgoats

04/15/2019 at 21:29 |

|

As a small business owner, Iím fairly happy with this yearís taxes. A bit more breathing room, all being plowed back into the business while the gettin's good.

boredalways

> Honeybunchesofgoats

boredalways

> Honeybunchesofgoats

04/15/2019 at 21:29 |

|

Cut taxes that few like, s lash jobs and the ability to do audits (...like 45's *wink wink*), yet the IRS needs more money to operate.

I am not looking forward to the next recession at all.

FUCT IT, I too tired to talk politics....

Let's try it out!

> Honeybunchesofgoats

Let's try it out!

> Honeybunchesofgoats

04/15/2019 at 21:31 |

|

Hey, Iím below the poverty line, made absolute garbage last year. Got about $1300 or so back this year. Still a left winger. Those tax breaks havenít netted me a job, and even if they did, I was working in 08, I know how it goes.

Vote your pocketbook.† Remember that your pocketbook might disappear tomorrow, and you may need help too.† Damned shame Obama didnít take advantage when he should have like FDR did.

Honeybunchesofgoats

> boredalways

Honeybunchesofgoats

> boredalways

04/15/2019 at 21:32 |

|

I am. Iím going to buy the fuck out of market index ETFs once everything bottoms out.†

Svend

> Honeybunchesofgoats

Svend

> Honeybunchesofgoats

04/15/2019 at 21:44 |

|

Unless your self employed here in the U.K. and have to do your own tax returns. We are on PAYE (Pay As You Earn), in that they look at how much you got paid the previous year as to how much should come out of your pay cheque each month over the whole year.

But we are also allowed a certain amount (for me itís £11,000) a year before you start paying taxes. So rather than getting a large tax bill or refund at the end of the year, itís averaged out over the year, and if itís found we paid a little too much this year or too little, then the following year the tax is altered.

No tax return hassle, equal and fair system and each April we get a breakdown from the government in the form of a P60 which tells us how much was deducted so we can check it, and if necessary contest it.

Happy days.†

Honeybunchesofgoats

> Svend

Honeybunchesofgoats

> Svend

04/15/2019 at 21:49 |

|

The £ 11,000 sounds like the standard deduction we have, but up front.

That actually sounds great. I tend to prefer underpaying on taxes rather than overpaying and getting a refund, so Iíd love a system that just handles it for me .

Iím confused, though. Surely you have Andrew Lloyd Webber types who want any deduction possible. How does that work?

nj959

> Honeybunchesofgoats

nj959

> Honeybunchesofgoats

04/15/2019 at 21:58 |

|

They move to the Isle of Man.

Svend

> Honeybunchesofgoats

Svend

> Honeybunchesofgoats

04/15/2019 at 22:22 |

|

They are on a much higher tax bracket and would also be classed as self employed so would have an accountant to do their taxes for them. Others may move their tax base abroad, if you live outside the U.K. for a certain amount of time you neednít pay all your taxes here but still have to pay some others taxes.

Only American, Burma and a few others have a citizenship tax rather than a residency tax. So an American who lives in the E.U. would pay the tax in the country they live in, they have to pay tax to the U.S. even if they donít live there.

Itís the issue Megan and Harry are going to go through. Megan is going for her British citizenship and giving up her U.S. citizenship, but to do that she must live here for at least five years and to renounce her citizenship her and her hubby would have to submit a tax return to the U.S. before she can renounce it. Her child will be classed as a dual U.K./U.S. national because at the time of birth the mother is a U.S. citizen. And as the child canít give up their U.S. citizenship before they are 16, they will still have to submit three years of tax returns. Many countries call the U.S. system as the Ďaccident of birth.

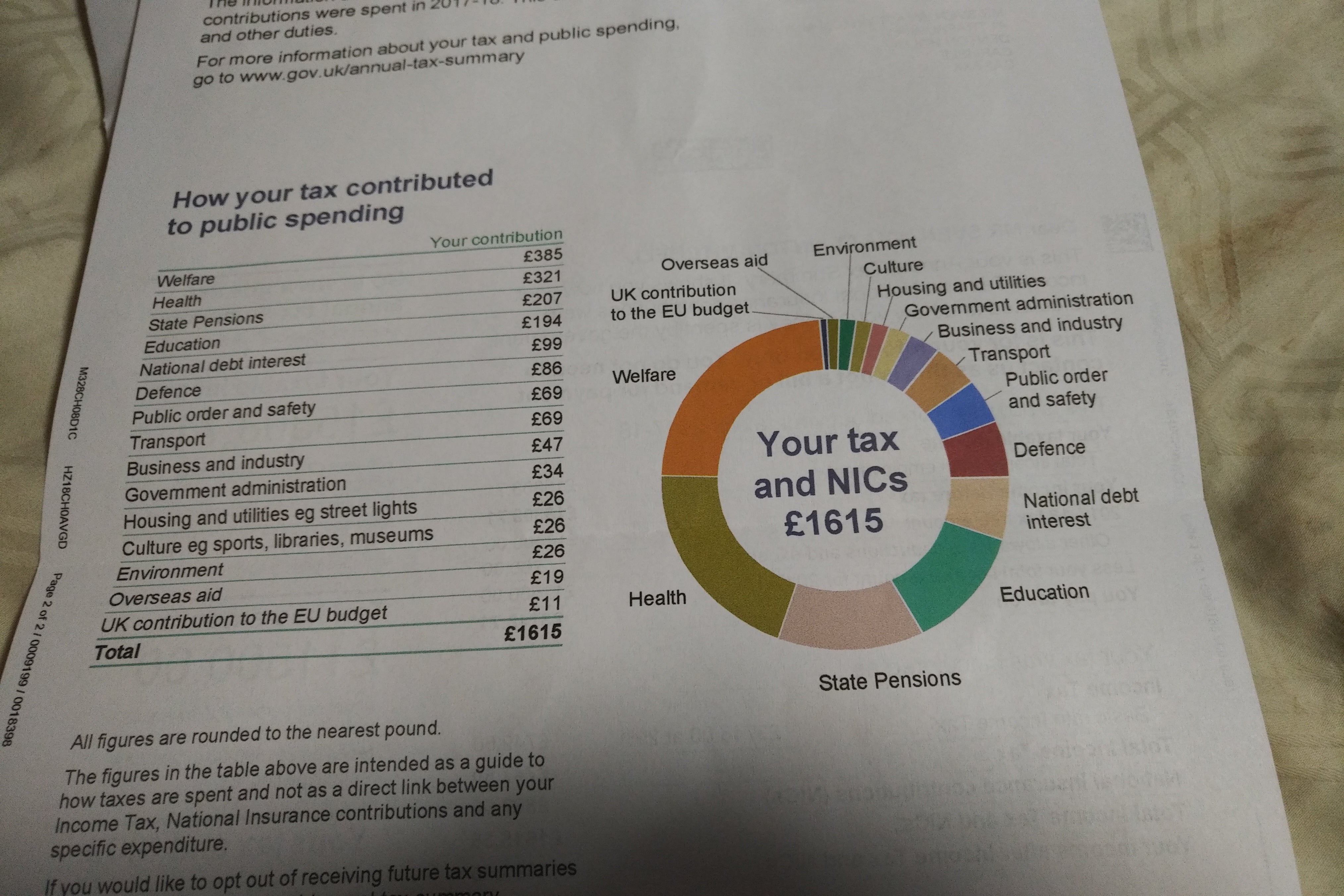

This isnít the P60 form but it does say how much I paid and why a nd where it went to.

†

gmporschenut also a fan of hondas

> Honeybunchesofgoats

gmporschenut also a fan of hondas

> Honeybunchesofgoats

04/15/2019 at 22:32 |

|

Iím -500 from last year

wafflesnfalafel

> Honeybunchesofgoats

wafflesnfalafel

> Honeybunchesofgoats

04/15/2019 at 22:51 |

|

flee to gold!† flee to gold!

Eric @ opposite-lock.com

> Honeybunchesofgoats

Eric @ opposite-lock.com

> Honeybunchesofgoats

04/15/2019 at 23:45 |

|

Thatís huge. My reduction wasnít massive, but it was a handful of shitboxes. A lot of people are tripping publicly, but I donít know anyone that isnít keeping more of their paychecks.

A lot of people are deeply confused by paying less taxes overall, getting bigger paychecks, but ending up with a tiny tax return or even owing a bit. They donít understand that this is what you want to have happen.

Eric @ opposite-lock.com

> wafflesnfalafel

Eric @ opposite-lock.com

> wafflesnfalafel

04/15/2019 at 23:52 |

|

Flee from gold at that point. Someone will buy it for far more than it is worth.

gmporschenut also a fan of hondas

> gmporschenut also a fan of hondas

gmporschenut also a fan of hondas

> gmporschenut also a fan of hondas

04/16/2019 at 00:15 |

|

I should clarify Owing† 500 more

LimitedTimeOnly @ opposite-lock.com

> Honeybunchesofgoats

LimitedTimeOnly @ opposite-lock.com

> Honeybunchesofgoats

04/16/2019 at 08:28 |

|

I said this on another thread, according to TurboTax I paid 14.5% on my household gross income for 2018, paid 15% for †2017, and generally have varied between 14% and 15% for the previous several years. So, pretty much no sense of change for me.

nermal

> Honeybunchesofgoats

nermal

> Honeybunchesofgoats

04/16/2019 at 09:10 |

|

I made significantly more & paid about the same. Iíll take it.

Galileo Humpkins (aka MC Clap Yo Handz)

> Honeybunchesofgoats

Galileo Humpkins (aka MC Clap Yo Handz)

> Honeybunchesofgoats

04/16/2019 at 10:59 |

|

We ended up paying about 3

5% more this year than last (Fed, IL, & MN). However, that is only because our income increased

. So, all in all, Iím not going to complain. I havenít bothered to figure out, all things being equal, if we wouldíve owed more/less or been returned more/less.